Les autocallables sont des produits « structurés » (lire « complexes ») qui permettent à son acheteur de profiter partiellement de la performance d’un sous-jacent sans en supporter tous les risques.

Quels éléments constituent un autocallable ?

- Le capital de départ, payé par l’investisseur (M Dupont) à l’émetteur (une banque).

- Le sous-jacent: l’actif sur lequel les paiements de l’autocallable vont être calculés. Un des sous-jacent les plus utilisés est l’Euro Stoxx 50

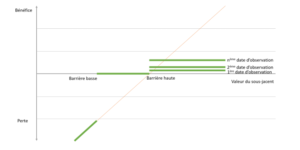

- Le coupon: reçu par l’investisseur si le sous-jacent dépasse la ‘barrière haute’. Ces derniers années les coupons ont été entre 6% et 12% par an.

- La date de maturité: date jusqu’à laquelle le produit peut rester en vie. Elle intervient souvent dans 2 à 8 ans lors de l’émission.

- Les dates d’observation: dates auxquelles la valeur du sous-jacent est relevée afin de déterminer le remboursement du produit et/ou le paiement du coupon.

- Barrière haute : Barrière qui, si dépassée par le sous-jacent à une des dates d’observation, déclenche le remboursement par l’émetteur du nominal et du coupon cumulé. Le déclenchement se fait de façon automatique et non pas discrétionnaire, voilà pourquoi ce sont des « auto » callables. Souvent, elle est égale à 100% de l’indice à la date de d’émission.

- Barrière basse: Barrière qui, si dépassée par le sous-jacent à maturité, supprime la protection du nominal investi par l’investisseur. Dans ce cas, l’investisseur supporte une perte proportionnelle à la perte du sous-jacent. Elle est souvent fixée à 40% de la valeur initiale de l’indice.

Le retour pour l’investisseur

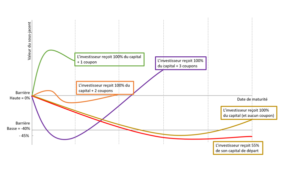

Considérons maintenant que le sous-jacent est un indice boursier. On peut établir 3 scénarios :

- Scénario 1: l’indice augmente (économie en expansion) : l’investisseur reçoit alors son capital de départ et le coupon. Il aura profité de la hausse des marchés dans la limite du coupon.

- Scénario 2: l’indice baisse mais ne franchit pas la barrière basse à maturité (économie en récession). L’investisseur reçoit le nominal mais pas de coupon. Les marchés ont baissé mais l’investisseur n’a pas souffert de perte.

- Scénario 3: l’indice baisse et dépasse la barrière basse (économie en forte récession). L’investisseur perd une partie de son capital de départ.

Flux pour un autocallable ‘Athéna’ qui paie le coupon seulement à terme.

Des autocallables ‘Phoenix’ avec coupon périodique existent.

Le retour pour l’investisseur :

Le retour pour l’émetteur

Le retour pour l’émetteur est, simplement, l’inverse du retour pour l’investisseur.

Typiquement l’émetteur (la banque) utilise le capital payé par l’investisseur (M Dupont) pour acheter le sous-jacent. L’émetteur se retrouve ainsi avec un portefeuille :

Portefeuille = (short) autocallables + (long) indice

Payoff portefeuille = Payoff (short) autocallable + Payoff (long) indice

Le marché des autocallables aujourd’hui et la situation pour les émetteurs

Globalement pour les autocallables qui sont sur le marché (ceux émis au plutôt en 2012), nous témoignons d’une baisse du subjacent qui ne dépasse par le - 40% (barrière basse classique des autocallables). Nous nous trouvons alors dans le scénario 2 de ceux décrits plus haut.

Evolution de l’Euro Stoxx 50

Les implications de ce scénario 2 sont :

- Les autocallables qui arrivent prochainement à maturité seront remboursés à 100% du capital. La vente du sous-jacent (indice) produit une entrée de cash insuffisante pour rembourser l’investisseur. Les banques constateront une sortie de cash et une perte.

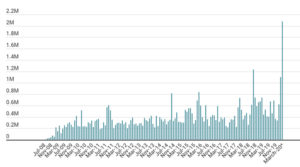

- Les autocallables qui restent en vie ont vu leur durée moyenne de vie s’allonger. La date espérée de remboursement d’un autocallable dépend de la date espérée à laquelle l’indice dépasse son niveau de départ. La probabilité que cet événement intervienne s’est amoindrie. Si le sous-jacent (l’indice) dépasse le niveau de départ d’ici la maturité de l’autocallable, l’investisseur recevra un coupon cumulé. Dans le « business plan » de l’émetteur d’un autocallable, c’est le cash venant du dividende ou la plus-value qui servent à payer ce coupon. Avec des durées de vie plus longues, les émetteurs doivent couvrir le risque lié à l’incertitude de perception de dividendes pendant plus longtemps. Les instruments utilisés pour le faire sont les futures sur dividendes ou alors les swaps OTC. Récemment, le trading de futures sur dividendes a été massif :

Volume de négoce de futures sur dividendes sur l’Euro Stoxx 50

Source : Eurex

En plus d’une tendance baissière, le marché actions a été un marché volatile. Techniquement, les barrières haute et basse sont respectivement une position longue sur un call et un put. Les « lettres grecques » de ces options ont bougé rapidement avec les mouvements du marché d’actions. Bâle III demande aux banques une couverture des risques plus active et les instruments de couverture des risques liées aux autocallables ont vu leur demande augmenter, avec des coûts supplémentaires pour les émetteurs.

Et les dividendes non distribués ?

Suite au Covid, nombreuses ont été les sociétés qui ont décidé de ne pas distribuer les dividendes qu’elles avaient déjà annoncés pour 2020. Ceci est une première dans l’histoire (un « évènement de queue ») et les émetteurs d’autocallables n’avaient pas couvert ce risque. A lui seul, ce fait a généré une perte de plus de 500M€ pour le système bancaire français.

| SG | BNP | Natixis | |

| Résultat liée à la non-distribution des dividendes déjà annoncés | - 200M€ | - 184M€ | - 130M€ |

| Résultat de l’activité Actions à Q1 2020 (variation par rapport à Q1 2019) | 9M€ (-99%) | - 87M€ (-120%) | -32M€ (-125%) |

Pour conclure

Dans un contexte de taux bas, les investisseurs ont montré ces dernières années un appétit pour les autocallables qui proposaient des retours attractifs. En 2019, les autocallables ont représenté 60% des émissions de produits structurés et le marché en est inondé.

Les banques françaises sont les plus grands émetteurs au monde et on s’interroge aujourd’hui sur leur exposition à ce type d’instruments. Confrontés aux mêmes événements, les banques américaines plus diversifiées, ont parvenu à montrer des résultats positifs dans leurs activités actions.

Certains analystes y voient des « mines antipersonnel » ou la « prochaine bombe » du système financier.

Votre contact